Between 1980 and 2023, the average annual cost of attending and living at a four-year college in the United States increased by 155%, according to the National Center for Education Statistics — bringing the average cost of tuition to $36,436 per student per year.

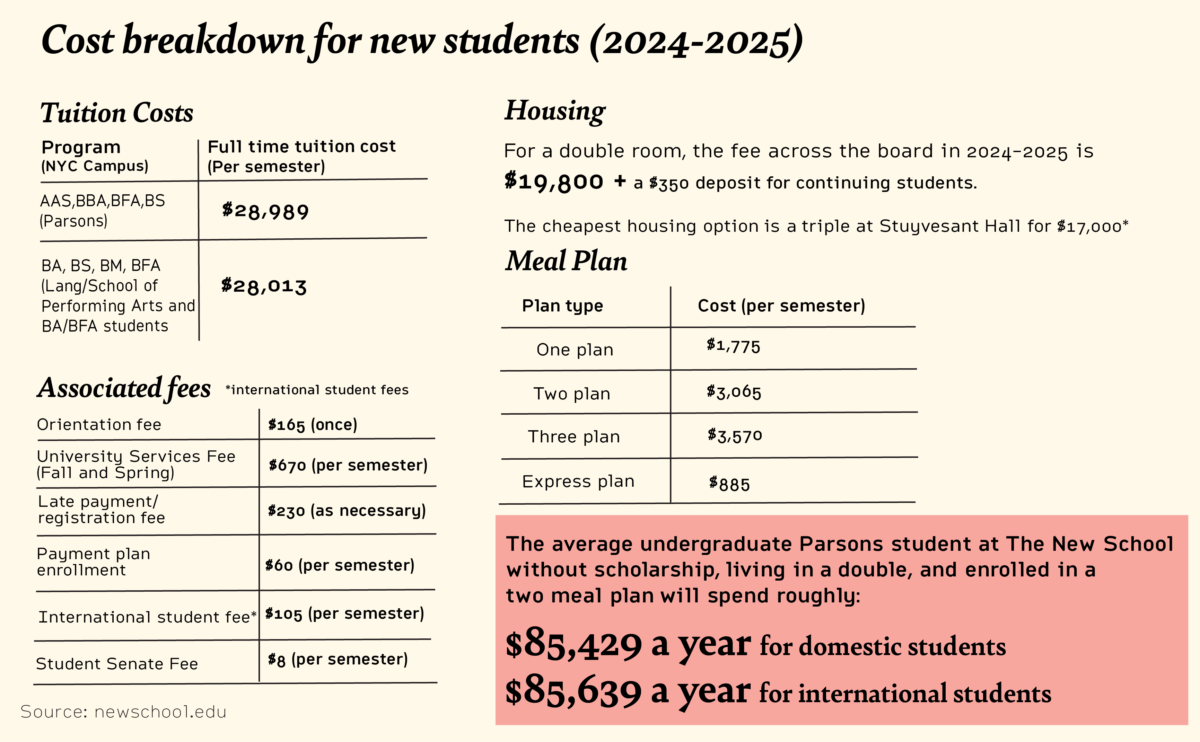

However, during the current academic year, tuition alone for a full-time student at The New School can run you a bill of around $60,000 a year. A price tag that reflects a country-wide struggle in higher education to balance spending and revenues.

In an email last month, The New School announced that it is raising tuition by 4.3% annually for incoming and current students enrolled after the 2022 part-time faculty strike. This raise exceeds the university’s average five-year increase of 2.29% annually.

But, the flat rate for tuition does not reflect the true cost of attending any university in the U.S. Other fees, living expenses, materials, and meal plans make up a large portion of the total cost of attendance. Those opting to live on campus can spend anywhere from $17,000 for a triple room at Stuyvesant Hall to $23,000 for a single room in any of the dormitories.

First-year undergraduate students living on campus are automatically enrolled in the two meal plan, which costs $3,570. Students who live off-campus can choose to enroll in a meal plan of their choice. First-year students cannot opt out of the dining plans unless they receive an exemption from Student Disability Services or Campus Card Services for religious reasons.

There are also many associated fees with attendance, such as orientation and per-semester fees like the University Services Fee which costs $670 each semester. According to the university website, this fee covers “added conveniences such as lifetime access to e-transcripts and e-diplomas, and one replacement ID card.”

But these numbers don’t encompass the other costs of living that many TNS students need to pay while living in New York City, such as outside dining, transportation, and materials for school. According to The New School’s Tuition and Fees estimator, which is available on the university’s site for different programs, books and supplies, miscellaneous and personal expenses, and transportation will cost students roughly another $2,200 altogether.

Michael Distefano, a fourth-year screen studies major at Eugene Lang College of Liberal Arts, says a major expenditure for him during his time at TNS has been on equipment and materials for his projects.

“I work a lot with equipment and it’s like you have to get the equipment and then figure out how to get it to the next place. So now you’re going into debt taking Ubers and getting on the subway multiple times or whatever it may be,” he said.

While TNS offers different grant options such as CESJ Mini-Grants at Lang, the Eugene Lang Opportunity Awards, and Capstone Grants for students working on their capstone projects, the cost of supplies for classroom projects is often taken on by students.

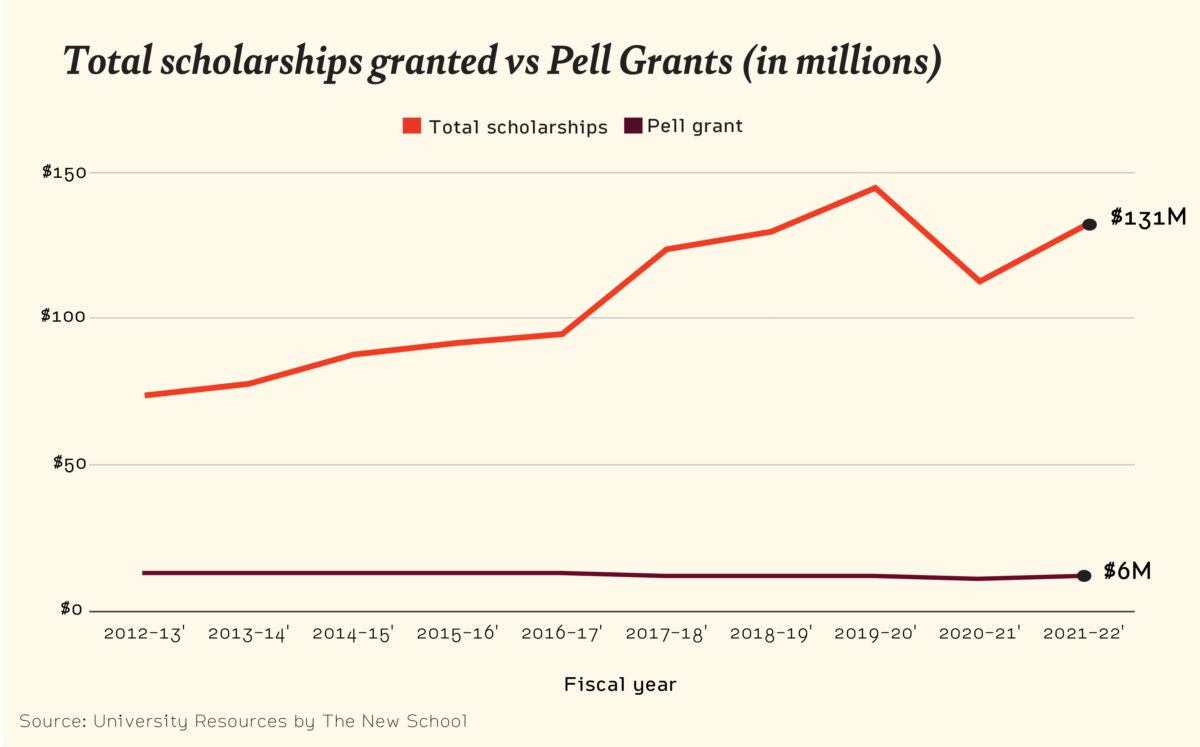

Students who attend TNS have access to a variety of financial aid packages, and scholarship options depending on both merit and need. Federal Student Aid, an office of the U.S. Department of Education, offers various types of financial assistance in the form of grants for those who fill out the Free Application for Federal Student Aid (FAFSA) form. One example is Pell Grants, which are offered to students who exhibit significant financial need and have not received a bachelor’s or professional degree. Unlike loans such as direct subsidized and unsubsidized loans, grants do not have to be repaid to the government.

TNS also offers merit-based scholarships to students, participates in state-based programs such as New York State’s Tuition Assistance Program, and allows students to earn money to cover their educational expenses through Federal Work Study if it’s included in their FAFSA financial aid package.

Data from The New School shows that while the monetary value of scholarships has increased overall, the amount allocated to Pell Grants has remained relatively stagnant since 2013. According to the Education Data Initiative, 71% of Pell Grants in 2023 were given to public university students, versus the 13% that go to private, nonprofit universities like TNS. In March, President Biden announced he is seeking an additional $2.1 billion for the next fiscal year to allocate towards Pell Grant funding, which would potentially increase the maximum award value from $7,395 to $8,145.

Catharine “Cappy” Hill is the former President of Vassar College, former Provost at Williams College, and current Managing Director of Ithaca SNR, a research group that focuses on post-secondary education. She believes financial transparency for college students is key.

“When students get a financial aid award letter, it’s actually still hard to parse out. What am I paying, and what am I borrowing? And that should be absolutely crystal clear,” she said.

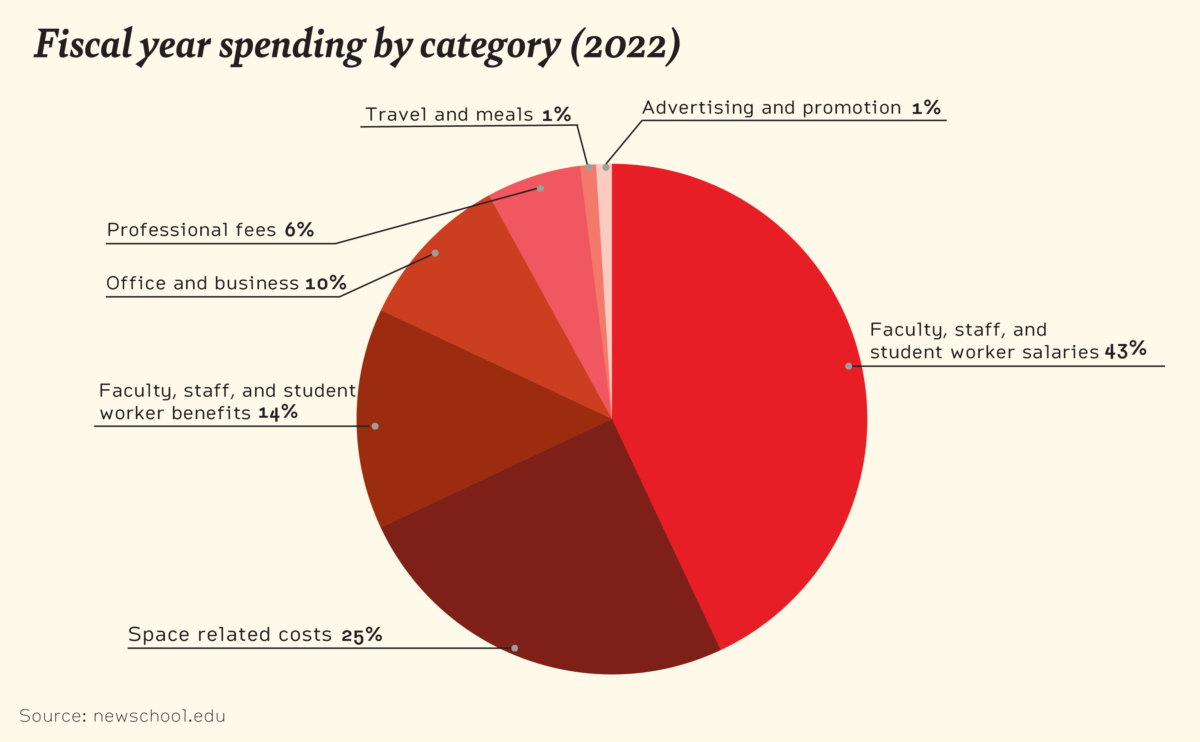

According to Hill, a major reason for tuition increases across the nation is a steady increase in labor costs, resulting from union bargaining negotiations or the raising of minimum wage on a state level to try to meet costs of living. Professors and faculty are also skilled workers. Unlike other supply chains, where when the cost of labor increases, product quality is decreased to help companies meet their bottom line — higher education cannot cheapen the quality and resources it provides, Hill claims.

“It’s a resource allocation question. You can pay your faculty, you can put more money into need-based financial aid. Unless you can figure out a way to use fewer faculty, it’s hard to reallocate the resources … but ultimately, even nonprofits have a budget constraint. And costs have to equal revenues,” she said.

Labor, which has become a contentious topic at the university since recent strikes, makes up for a large portion of TNS’s spending. The university uses roughly 43% of its spending towards faculty, staff, and student salaries, and 14% towards faculty, staff, and student benefits.

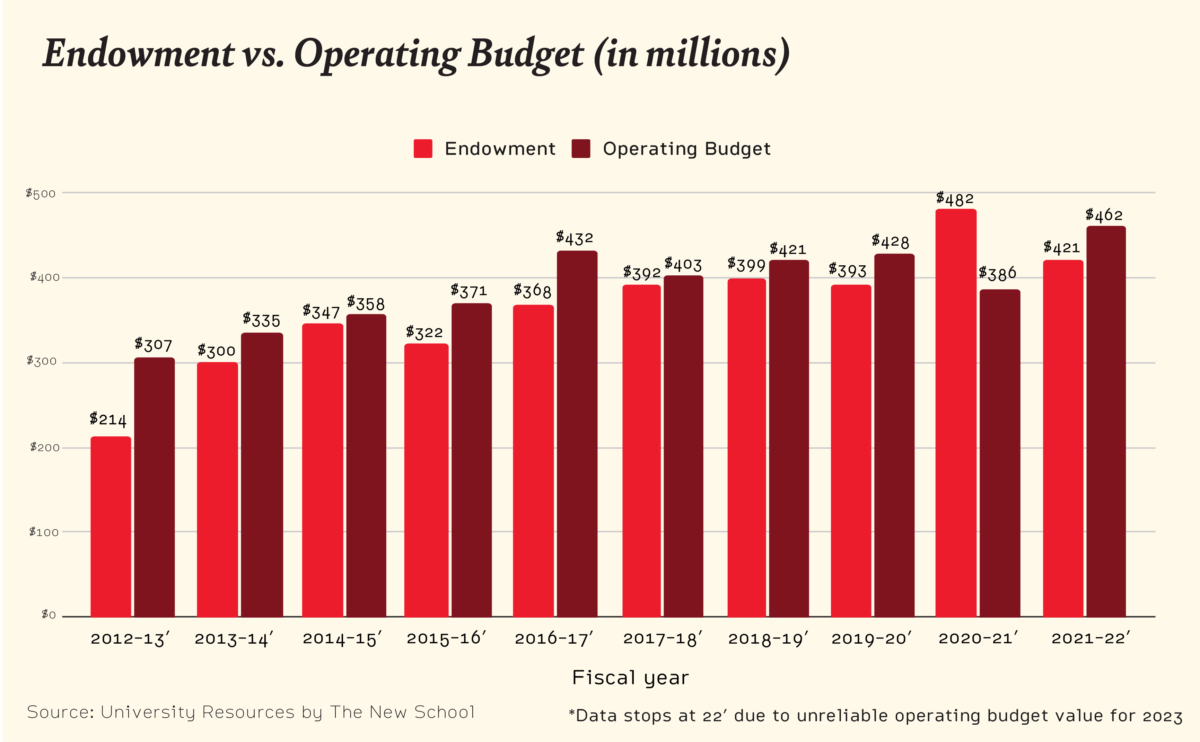

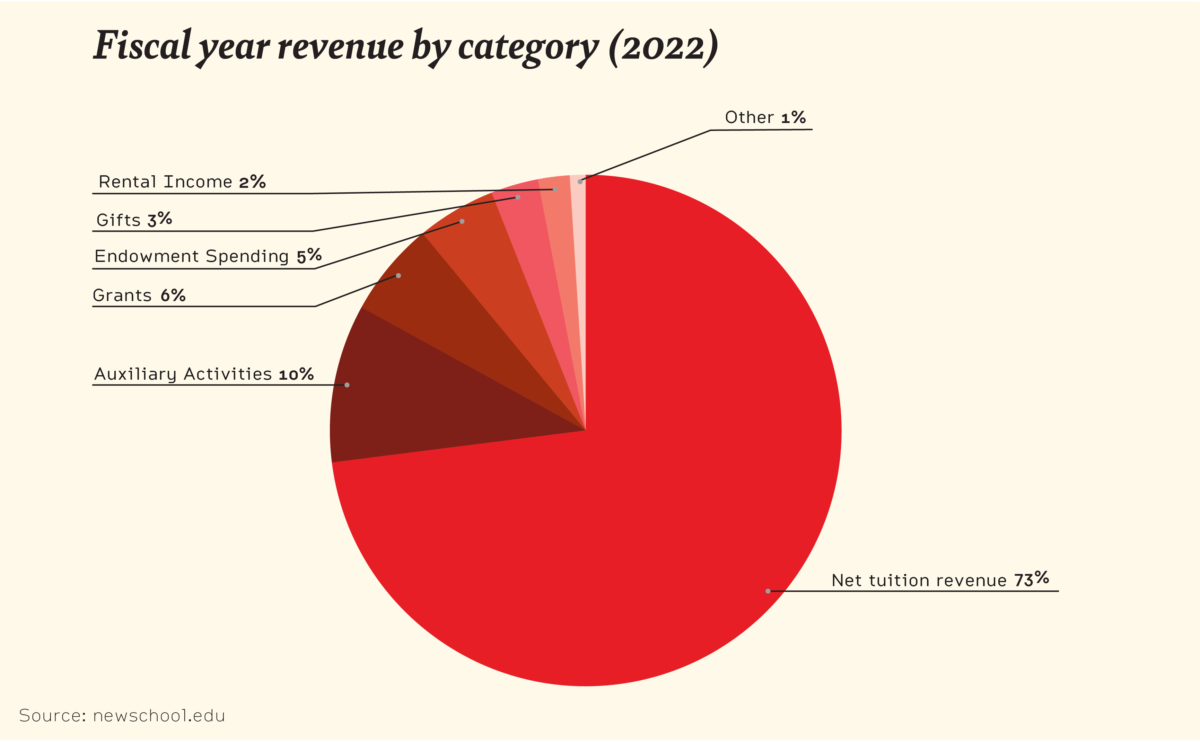

In order to meet spending, The New School relies heavily on tuition. In 2022, 70% of the school’s revenue came from students’ pockets. The university has an endowment with a market value of $449,893,000 in 2023, which is smaller in comparison to many major New York City based universities, such as New York University whose endowment is $5.9 billion. According to the university’s Form 990, a tax form that nonprofits like The New School must file, “The university’s endowment spending policy is designed to provide a sustainable and predictable flow of funds to support annual operations.”

Endowment funds are used by nonprofit organizations like some private universities to earn investment income to use partially for operations and partially for reinvestment. This explains the need for a large amount of tuition funding to meet the operating budget of the university. At TNS, the Investment Committee of the Board of Trustees makes the investment decisions for the endowment fund. The policy for spending such funds is intended to balance spending and revenues while also preserving the university’s future purchasing power.

Hill explains that endowments are a large reason why universities like TNS are unable to do need-blind admissions, a practice that allows universities to not factor in a student’s ability to pay full tuition in the admissions process.

Hill also expressed universities are not immune to financial hardship, and in the worst cases, shutting down.

“What we’re seeing is schools are actually going out of business. A small college, Goddard College, had to close its doors because it couldn’t make that budget constraint matchup anymore,” she said.

“Universities such as TNS will have to manage spending, revenues, and the ability of students and families to take on the invoice they send home,” Hill said. Tuition increases are reflective of an attempt to balance the spreadsheets and continue providing a high-quality education and services for students.