On Wednesday night, 30 people gathered inside the Orientation Room at 2 West 13th Street for a university-wide teach-in to educate students about the student loan debt crisis.

The Office of Social Justice Initiatives organized the event to raise awareness about the nature of student loan debt in the United States and how the vast amount of currently outstanding student loans affects college graduates.

The Office of Social Justice Initiatives organized the event to raise awareness about the nature of student loan debt in the United States and how the vast amount of currently outstanding student loans affects college graduates.

“The Federal Reserve of New York State says that the student loan market is complex,” said Pam Brown, a sociology student at The New School for Social Research, who co-organized the event. “We’re here to talk about how this debt crisis developed and how to stop it.”

Jesse Villalobos, The New School’s associate director of Social Justice Initiatives, led a discussion panel followed by a question-and-answer session. Panelists included Samir Sonti, a Cornell University graduate student majoring in government; Andrew Ross, social and cultural analysis professor at New York University; and Sarah Jaffe, associate editor at the non-profit news site Alternet.

Today, an American college education costs six times more than it did in 1980, while the total amount of student loan debt is expected to surpass $1 trillion this year.

“Two-thirds of these debt holders are between the ages of 20 to 30,” Sonti said.

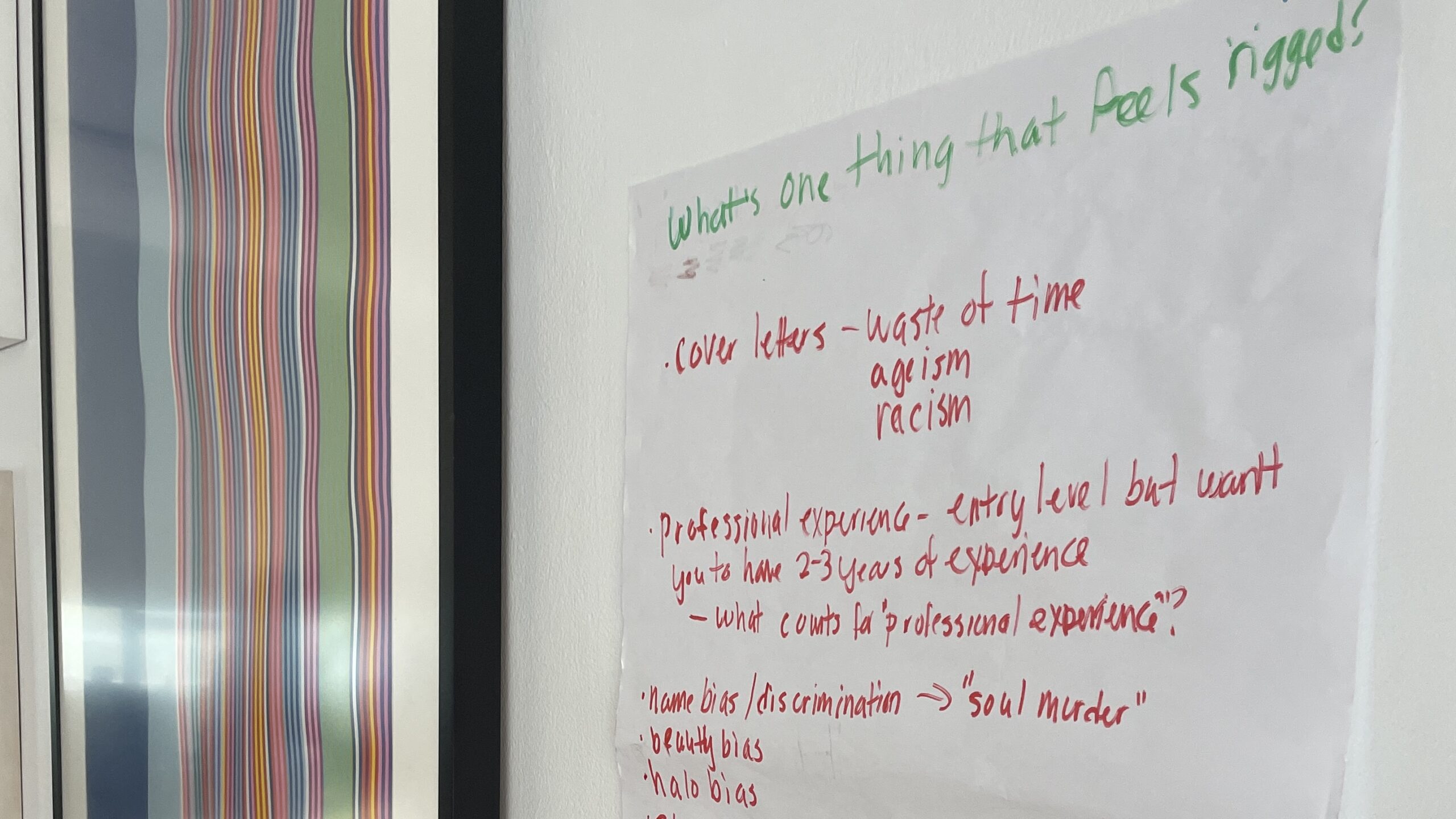

This financial burden primarily affects young people recently out of college and looking for employment.

Most panelists criticized the national banking system, which helps finance student debt. Gina, who asked not to give her last name, completed her Master’s Degree in anthropology at The New School in 1994. Ten months ago, after hearing about the recent federal bank bailouts, she decided to stop filing her student loan payments.

“I don’t know what to do,” she said. “I have some knowledge of the dealings with the movement and banking. I don’t know which direction to go. I’m a generation older.”

Jaffe and Ross said that the student loan debt could hardly be compared to other financial predicaments, such as the late 2000s housing crisis.

“In regards to the housing bubble, there’s no equivalent with student loans,” said Ross. “A college degree is not a commodity asset. Degrees cannot be sold.”

Leave a Reply