For much of its existence, The New School’s Advisory Committee on Investment Responsibility has fought for relevance within the university. Now, three years into its mission, recent activity — including a correspondence with the U.S. Securities and Exchange Commission — has seen the ACIR intent on emerging as a key organizational force at The New School and beyond.

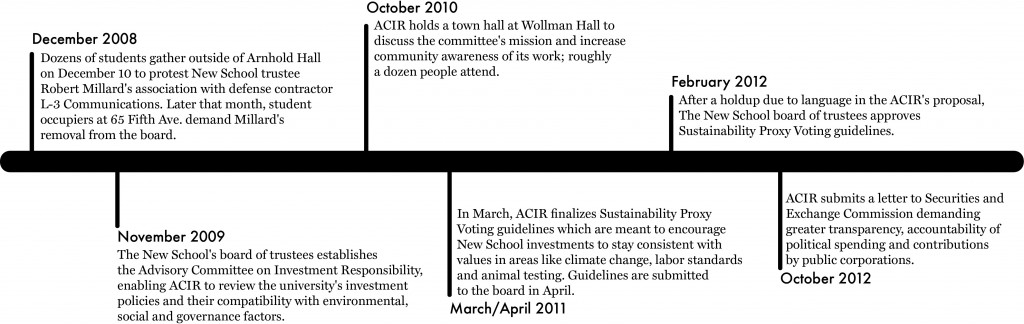

The ACIR’s journey began when dozens of students gathered outside of Arnhold Hall on December 10, 2008, to protest New School trustee Robert Millard’s association with defense contractor L-3 Communications. Millard’s position on L-3’s board of directors left students and faculty concerned about The New School’s ties to a company whose activities appeared to go against the very fabric of the university’s values. One week later, many of those same students staged an occupation at The New School’s 65 Fifth Ave. building. Besides demanding that then-President Bob Kerrey and then-Vice President James Murtha step down, their conditions also called for Millard’s removal from L-3’s board.

Kerrey, Murtha and Millard all survived the controversy at the time. But 11 months after the occupation, the university established the Advisory Committee on Investor Responsibility. The ACIR consists of students, faculty, staff and trustees who review The New School’s endowment investment policies, which are managed by the board of trustees’ investment committee, and advise the board on investment practices that account for environmental, social and governance factors — in essence, “responsible” investment.

The ACIR got off to a rough start; at an open house presentation at Wollman Hall in October 2010, where students were invited to speak with Kerrey and other administrators about the committee, less than a dozen people showed. The outrage that had led students to occupy a university building and call for Millard’s removal had seemingly died down, and with it the momentum necessary to implement change at the highest levels of the university.

“There’s always a ton of support to talk about transparency and accountability and fiscal responsibility [at The New School],” said ACIR member Chris Crews, a Ph.D student at The New School for Social Research. “It makes for an easy talking point or a bullet on the negotiating list of demands you want. But when it comes to sitting through two-hour long meetings every month and reviewing pages and pages of financial records, most students don’t care.”

Now, four years after that first student occupation at 65 Fifth Ave., the ACIR appears to have turned a corner. Last year, the committee succeeded in getting the trustees to pass a number of proxy voting guidelines that encourage The New School’s investments to stay consistent with its values in areas such as climate change, labor standards and animal testing.

And in October, the committee sent a letter to the Securities and Exchange Commission urging the SEC to increase the level of transparency surrounding political contributions by public corporations. In doing so, the ACIR became the first organizational body from any university in the country to address what has become an increasingly contentious issue since the U.S. Supreme Court’s Citizens United v. Federal Election Commission ruling, which prohibited the government from limiting corporate political spending.

“The New School is the first university to send a letter to the SEC [concerning rulemaking],” said Dan Apfel, executive director of the Responsible Endowments Coalition, a Brooklyn-based organization advocating responsible investment practices by universities. “I wouldn’t say that no other schools care about this issue, but The New School is definitely blazing a trail on political contributions and university investments.”

Though the letter’s impact remains to be seen, ACIR members are enthusiastic about the quantifiable work the committee is getting done in the fourth year of its existence.

“Taking on an issue and becoming a leader in that issue is a different matter. It is a lot more fun, [and] a lot more effective,” said New School trustee and ACIR member Bevis Longstreth, who served as commissioner of the SEC from 1981 to 1984. “I think when people in this school learn about what we’re doing, they will want to join in.”

According to ACIR chair Terra Lawson-Remer, an assistant professor of international affairs at The New School for Public Engagement, the committee’s correspondence with the SEC is meant to initiate a discourse around an issue that directly concerns universities around the country.

“The unaccountable and non-transparent role of money in politics is very corrupting of the democratic process,” Lawson-Remer said. “[The Citizens United ruling] exacerbated the problem significantly, in my opinion.”

The letter, which Lawson-Remer drafted, cites a 2011 report by the National Association of College and University Business Officers stating that American colleges and universities collectively hold approximately $400 billion in endowment investments. Of these investments, over a quarter are held in publicly traded companies.

Lawson-Remer said that the letter’s impact will largely be determined by how effectively it can “galvanize larger public outcry and pressure on the SEC” by other universities. It is a sentiment echoed by ACIR member and New School for Social Research student Izza Aftab, who is serving her first semester on the committee.

“I think the basic idea, by making [the letter] very public, is that we get other schools on board,” Aftab said. “Because schools, altogether, have a substantial amount that they’ve invested in the financial markets.” The goal, Aftab added, is that other universities follow the ACIR’s lead in relaying their own concerns about corporate political financing. “If enough schools do that,” she said, “the SEC is not going to discard [the issue].”

Aftab said, however, that the ACIR’s recent activity is also meant to revitalize community interest in the committee’s work within The New School itself — particularly among the very student body that so vehemently demanded institutional transparency and accountability four years ago.

“The students who are taking massive loans coming into this school, they should know where this money is going, they should know why this money isn’t going in a particular place, and they should know what stance we’re taking,” she said.

With reporting by Ada Akad

Leave a Reply