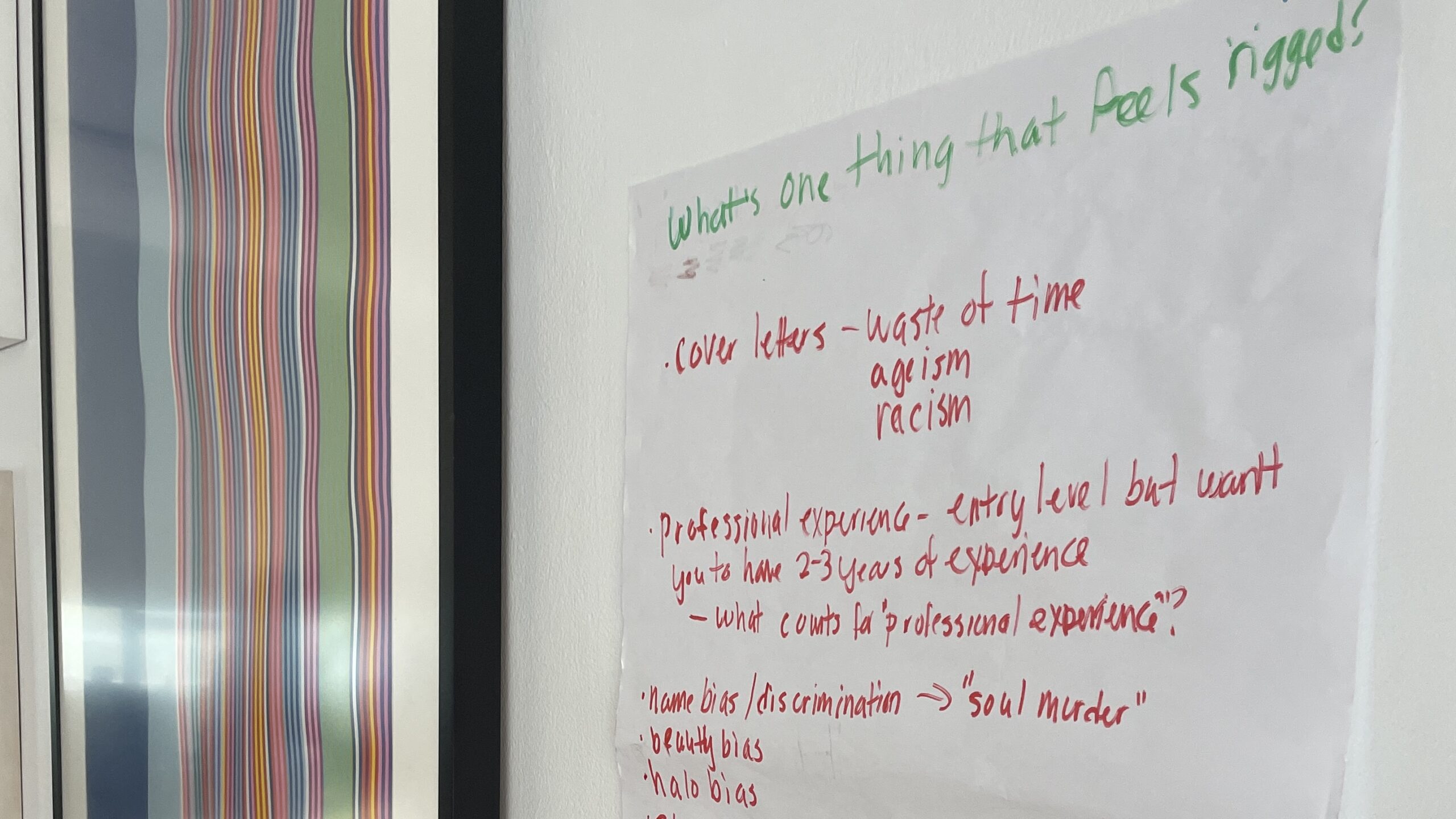

Examining Ever-Rising Tuition.

With the rising costs of living in New York City — and the even higher costs of studying at The New School — some students toy with the idea of transferring to more modestly priced universities. Most pass up the thought, as evident by an 82 percent freshmen retention rate, superseding the 77 percent national average. But some students, unable to afford the ever-rising costs of the city and the university, pack their bags and head home.

Jalil Simpson was one such student. In 2010, the aspiring photographer studied at The New School, willing to endure the financial risk for Parsons’ alluring reputation and networking opportunities.

But when an unexpected $8,000 balance appeared for the next semester, Simpson, like many students, realized that remaining at The New School no longer seemed economically feasible.

“I was definitely upset,” Simpson, a Pennsylvania native who transferred to the publicly run Community College of Philadelphia for the following semester, told the Free Press. “I would have liked to have at least spent the whole year. I definitely enjoyed the time I was at Parsons.”

The Free Press was unable to gather a statistic for how many students have, like Simpson, left the university for financial reasons. But nationally, Americans are beginning to question the fiscal worth of a college degree, and they wonder why tuition has increased so drastically in recent years.

Since 1985, college tuition has climbed more than 500 percent according to Bloomberg News, far outpacing the rate of inflation and other service-based goods.

Claire Potter, a history professor at The New School who has written extensively on the costs of higher education, said that while tuition must be understood within the larger economic context, there is also a lack of government oversight and support. “The high cost of tuition in this country is possible because there is no public commitment to subsidizing the cost of education, [or] regulating the hoarding of endowment funds at wealthy private institutions,” she said.

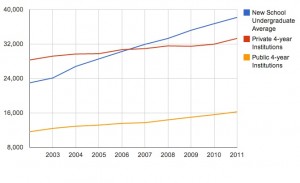

The average American private university costs about $32,000, while The New School’s tuition ranges between $24,840 and $39,368, depending on the division. Over the past decade, the university’s tuition has climbed about $15,000.

Infographic by Alexandra Ackerman

The cause of tuition hikes is a matter of contention. Those who charge university administrators nationwide with mismanagement blame an overly corporatized education industry for rising tuition costs.

But Robert Archibald, an economics professor at the College of William and Mary and author of the book, Why Does College Cost So Much?, believes that the rising costs of higher education can be traced to rising costs in service-goods in general, and must be understood in the larger economic context. “If you look at higher education and other goods that tend to go up faster than the inflation, they tend to be services where a lot of the service providers are highly educated,” he told the Free Press.

Universities can slash expenses, Archibald added, but doing so often has adverse effects on the university’s prestige. “Colleges are making efforts to cut costs, but you really have to be careful about cutting costs, because it has its drawbacks.”

*****

Unlike Simpson, who did not have to take out loans to fund his studies at The New School because of financial support, Lindsay Peters, a former BAFA student, will have to pay off loans for a school she never even completed.

“I guess I still had the naive mindset that, financially, there was a lot more aid being given out and that it would all work out,” she said. All of her loans for the first year were approved, but this year she was denied a PLUS loan from the government. “The extra subsidized loans The New School gave us just didn’t cover it,” she said.

The Director of Undergraduate Financial Aid, Lisa Shaheen, told the Free Press in an email interview that The New School’s undergraduate financial assistance take both need and merit into account. However, in graduate programs, merit remains the primary factor when universities allocate financial aid.

“Individual circumstances are taken into account if the student comes forward with information he/she would like us to consider when determining their awards,” said Shaheen.

She denied rumors that there had been any significant budget cuts to financial aid this year.

“We try always to maintain the same financial aid awards from year to year so that families can properly plan financially,” she added.

According to the 2012 New School factbook, a document put out by the Provost’s Office that breaks down trends and statistics at the university, 74 percent of undergraduates received financial aid last fall — 5 percent fewer than received aid the previous year. Yet the amount of money awarded to students increased by $3 million during that period.

The average student received just under $23,000 in financial assistance in Fall 2012. That money, according to Associate Director of Communications Sam Biederman, comes from a variety of sources, including scholarships from the New School and the state, federal grants, federal and state loans and federal work study.

The 2013 factbook is not yet available.

*****

Many students say that rising tuition, even with financial aid, is simply too much. And with the expenses of living in New York City, studying and balancing jobs to avoid student debt becomes unmanageable. Some students fear they will spend most of their adult lives paying off tuition debts.

“The combination of my subsidized and unsubsidized loans cover my full tuition,” said Amanda Mercado, a senior politics major at Lang. “However, I can tell you that my unsubsidized loans will bite me in the ass later.”

Mercado hopes to apply for jobs immediately after graduating so that she can pay off her loans before they gather interest.

Archibald, the economics professor at the College of William and Mary, thinks a college degree — despite its financial strains — pays off. “Both the probability of being employed and the average [salary of college graduates] make college a really good economic deal,” he said. “Even if you have to borrow, it still makes a lot of sense.”

The average college graduate earns $22,000 more annually than non-graduates, according to the College Board.

Archibald warned students against being overly cautious about manageable debt — which he set at about $30,000 — and said they should instead focus on graduating on time to avoid having to take out unnecessary loans.

Brown, the history professor mentioned earlier, feels that students must also be more aware of their finances.

“One thing every student can learn to do is be his or her own budget director,” she said, advising students to keep tabs of their expenses and live modestly within their means.

Still, she said that while college is a good investment, the amount of debt that some students take on is unmanageable, and might follow them into their future.

Pamela Brown, a Ph.D. candidate in The New School for Social Research’s sociology department, participated in the Strike Debt campaign, which sought to gather a critical mass of students to refuse to pay back their student loans.

Brown wants people to reanalyze what education means to our society. “The students are paying with their future… many have graduated college with $25,000 to $40,000 dollars worth of debt and are then unable to find jobs,” she said.

“I think we need to have a really broad conversation in our society and ask if we really want to have an education system that puts students in such large debt.”

Leave a Reply