As The New School’s tuition is slated to increase by 4.3% in the next academic year, amid a national trend of skyrocketing tuition prices, many students at TNS are left to navigate how to pay for their education. Whether through scholarships, loans, jobs, or help from parents, making it work in New York City — where the cost of living is 78% higher than the US average — is daunting.

The latest tuition increase, which will be applicable to students enrolled after the Fall 2022 part-time faculty strike, can cost students over $28,000 a semester without a scholarship. Although TNS offers many payment plan options, merit scholarships, and federal and state tuition assistance programs, students responsible for their bills often make major sacrifices to afford tuition.

Third-year Strategic Design and Management major Dottie Davis works 40 hours a week while maintaining her status as a full-time student. When she reached out to her advisor about dropping down to part-time status, she was informed that her scholarship would be significantly reduced, and it would cost her more to attend as a part-time student than as a full-time one because of the loss of aid. Davis ultimately had to continue as a full-time student in order to afford attending Parsons School of Design.

Although her job now provides her flexibility with her class schedule, she reflected on a time when that was not always the case.

“I definitely very much lucked out specifically with the job that I have now … but I remember sophomore year, I was working three jobs. I didn’t have any time to get any schoolwork done. Also, even though I was working three jobs, I somehow still had no money,” Davis said.

Eustakia Moreta, a third-year Culture and Media student, found herself in a similar situation. When she couldn’t meet her deadlines because of work, she chose to take a gap year.

“I ended up having to work 12-hour shifts just to be able to cover rent and everything … It got to a point where I had to pull all-nighters for a bunch of projects,” she said. Moreta said she is still recovering from the physical effects of overworking.

In 2022, according to The US Bureau of Labor Statistics, 43.4% of full-time students enrolled in a four-year university were employed. In 2017, the US Department of Education reported that of those students, the majority were working over 20 hours per week. Students who work more than 20 hours a week also tend to have lower grades and retention rates, due to navigating the balance between work, academics, and maintaining a social life.

Research has also shown that student loan debt directly correlates to an increase in psychological distress. Among 18- to 28-year-old Americans, increases of $1000 in student loan debt resulted in 6% higher rates of distress.

To afford to eat, Michael Distefano, a fourth-year screen studies major, has had to work several jobs throughout college. Since paying for the upfront costs of off-campus living has not been possible for him, he’s continued to rely on dorms for housing, a choice he believes has only added to his student loans.

The average rent for a one-bedroom apartment in 2024 is $3,760 per month in Manhattan, and $2,659 per month in Brooklyn. While some students find ways around these high costs by subletting rooms or splitting rent with multiple roommates, in order to rent an apartment, students or guarantors often have to meet specific income requirements and be able to pay broker’s fees, a security deposit, and occasionally the first and last month’s rent upfront. Beyond that, the new requirement for first-year students to live in campus housing may potentially complicate returning students’ ability to secure space in a dorm, despite the university reassuring students that this will not be the case.

“I feel like sometimes I had to sacrifice making my best work for like, having money to live,” Distefano said.

Sam Barone, a fourth-year interior design major, expressed a great deal of gratitude for his parents, who have been able to assist with the cost of living and tuition. Although Barone needed to take out some student loans, he still feels like he is in a fortunate position. Yet certain experiences, like studying abroad, felt inaccessible to him financially.

“I knew from the beginning, I was gonna have to take up student loans, and I’m very grateful my parents were able to help for so long. But I do have a part-time job. So I’m not always asking my parents for money,” he said

Relying on The New School for financial assistance, in the case of many students, requires a great deal of self-advocacy. The university has a Student Emergency Assistance Program, which offers one-time financial assistance to students who are experiencing “acute financial distress.” It’s meant to help students who are suffering from a temporary loss of job or are in need of clothing, food, or childcare.

Thalía Ysatis, a third-year integrated design major, requested funds from the financial aid office many times.

“When I moved out, I was in a bad financial spot, but I couldn’t live at home anymore. It was a really bad situation. So I just had to go,” she said. Having spent all her money on rent, she couldn’t afford food. So she turned to the emergency fund.

“They gave me a good amount of money,” she said, but felt that getting to this point required extensive effort and a large amount of personal accountability on her part to make use of these assistance programs. Ysatis said the emergency fund granted her $500 in support.

“You kind of have to really be consistent and persistent. Like, keep asking for help. Keep asking for more,” she said. At one point, Ysatis was unable to afford the subway fare. So, she went to the Financial Aid Office to get MetroCards, but said when she tried to use them, they had already expired.

“I felt badly going back there to be like ‘hey, these don’t work.’ The guy there looked like he was gonna cry,” she said. Though resources are often limited, Ysatis felt the staff cared about her situation. “They really want to help the students here. That’s one thing that I’ve learned. When you go to them, they really want to help you and they feel terrible that the institution doesn’t give them more [to] work with.”

Transportation costs are one of the major areas where students feel they need assistance. Last August, the one-way subway fare rose from $2.75 to $2.90, an increase that didn’t feel insignificant to students who commute to campus.

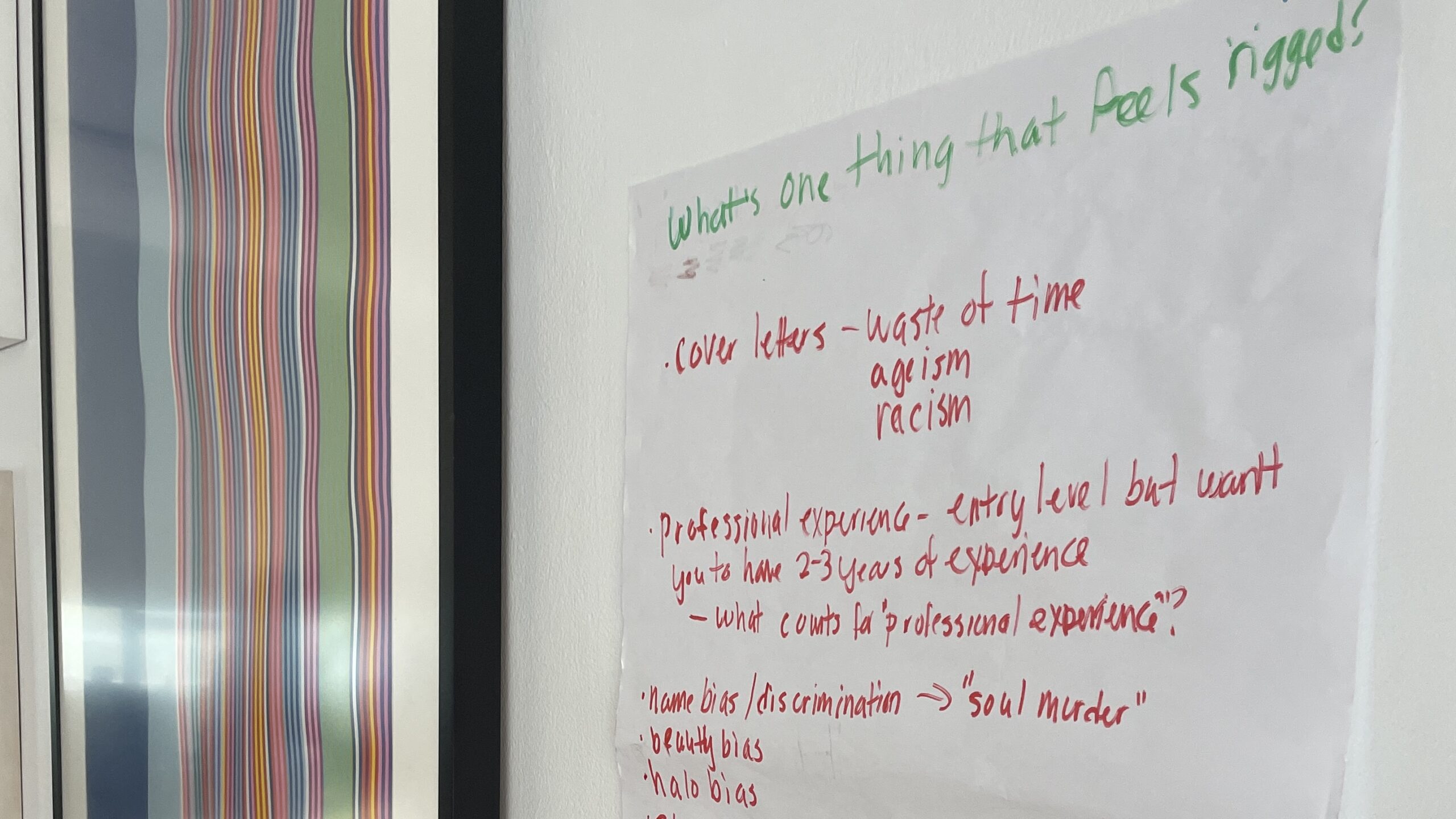

Students feel the university could do more to improve their overall experience, which at times feels isolating for those who have to support themselves. Suggestions that would improve the university experience for students who have to work include more funding for class projects that require outside materials, as well as more early morning and evening classes to accommodate work schedules.

“People like to say they’re broke even though they’re not … there definitely are people that worked as hard as I do and there are definitely people that have to work harder, but I would say there are a lot more people here with money than not,” Davis said.

Despite the stress of managing finances, making the most of campus experiences and putting effort into their studies makes the sacrifice worth it to some.

“The school is so expensive. And if you’re not trying then why are you here?” Barone said.

This article appears in Budget Blues, a running package of stories following the university’s finances.

Leave a Reply